Course of costing system-managerial accounting or value accounting together with equal unit calculation & journal entries

Describe value classifications and their significance.

Describe value classifications and their significance.

Clarify the variations in monetary statements for a producing firm versus a merchandising firm.

Clarify the variations in monetary statements for a producing firm versus a merchandising firm.

Record the price movement course of for a producing firm.

Record the price movement course of for a producing firm.

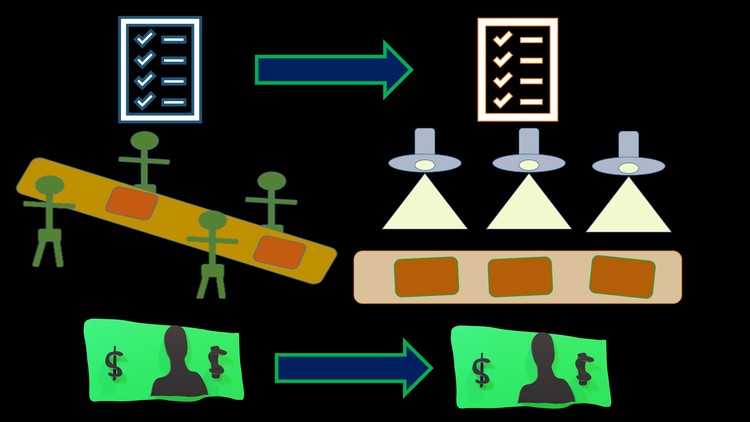

Examine a job value system and course of value system and clarify when every can be used.

Examine a job value system and course of value system and clarify when every can be used.

Describe the price flows in a course of value system

Describe the price flows in a course of value system

Clarify the idea of overhead and the way it’s utilized in a course of value system

Clarify the idea of overhead and the way it’s utilized in a course of value system

Calculate the predetermined overhead charge.

Calculate the predetermined overhead charge.

Allocate overhead to job utilizing estimates.

Allocate overhead to job utilizing estimates.

Calculate equal items of manufacturing

Calculate equal items of manufacturing

Allocate prices utilizing a First in First Out (FIFO) methodology

Allocate prices utilizing a First in First Out (FIFO) methodology

Allocate prices utilizing a weighted common methodology

Allocate prices utilizing a weighted common methodology

Course of costing system – Value Accounting – Managerial Accounting

We are going to begin by introducing managerial accounting or value accounting matters that apply to firms that manufacture utilizing both a job value system or a course of value system.

The course will describe classifications for prices and the significance of with the ability to classify prices in several methods.

We are going to listing and describe an overview of the method prices undergo as they movement via the accounting course of in a producing firm.

The course will examine the 2 main programs used to trace stock prices in a producing firm, the job value system, and the method prices system. We are going to focus on when an organization would use both a job value system or a course of value system.

We are going to focus on the movement of stock prices in a course of value system and observe the method of prices associated to uncooked supplies, that then movement to work in course of and manufacturing unit overhead, to completed items, and at last, are expensed within the type of value of products offered.

We are going to clarify the idea of overhead and why it’s wanted, together with the idea of precise overhead incurred and estimated overhead we apply to departments. The course will present learn how to calculate the predetermined overhead charge and learn how to use this charge to estimate overhead allotted to departments.

The course will report the journal entries associated to prices as they movement via the method value system together with journal entries for the switch of uncooked supplies to work in course of and manufacturing unit overhead, the incurrence of direct and oblique wages, and different overhead prices. We are going to enter journal entries to allocate overhead to work in course of and to switch prices from division to division and completed items. We may also enter journal entries to report gross sales transactions and associated prices of products offered.

We are going to calculate the price per equal unit and assign prices to ending work in course of and to quantities transferred out of departments utilizing each a First In First Out (FIFO) methodology and a Weighted Common Technique.

We may also focus on key phrases and definitions associated to a job value system and the way they’re utilized in apply.

Along with the academic movies, this course will embody:

• Downloadable PDF Information

• Excel Follow Information

• A number of Alternative Follow Questions

• Brief Calculation Follow Questions

• Dialogue Questions

The PDF information enable us to obtain reference data we will use offline and as a information to assist us work via the fabric.

Excel apply information can be preformatted in order that we will concentrate on the accounting course of and studying among the fundamentals of Excel, like addition, subtraction, and cell relationships.

A number of selection instance query helps us enhance our test-taking abilities by decreasing the data into the dimensions and format of multiple-choice questions and discussing learn how to method these questions.

Brief calculation questions assist us scale back issues which have some calculation right down to a brief format that might be utilized in a number of selection questions.

Dialogue Query will present a possibility to debate these matters with the trainer and different college students, a course of many college students discover very useful as a result of it permits us to see the subject from totally different viewpoints.

English

Language

Introduction

Introduction

PDF – 10 Managerial Accounting Introduction

10 Managerial Accounting Introduction

Accounting Comedian Break

Value Classifications

2 Value Classifications

PDF – 20 Value Classifications

20 Value Classifications

PDF – 30 Product Prices & Interval Prices.ENCODING

30 Product Prices & Interval Prices.ENCODING

PDF – 40 Prime Prices & Conversion Prices

40 Prime Prices & Conversion Prices

Accounting Comedian Break

Producer’s Monetary Statements

3 Producer’s Monetary Statements

PDF – 50 Producer’s Stability Sheet

50 Producer’s Stability Sheet

PDF -60 Producer’s Earnings Assertion

60 Producer’s Earnings Assertion

Accounting Comedian Break

Value Flows for a Manufacturing Firm

4 Value Flows for a Manufacturing Firm

PDF – 70 Manufacturing Actions Stream

70 Manufacturing Actions Stream

PDF – 80 Simply In Time (JIT) Manufacturing

80 Simply In Time (JIT) Manufacturing

Accounting Comedian Break

Job Value vs Course of Value System

5 Job Value vs Course of Value System

PDF 90 Job Value Vs Course of Value

90 Job Value Vs Course of Value

Accounting Comedian Break

Course of Value System Overview Utilizing FIFO Technique

6 Course of Value System Overview Utilizing FIFO Technique

PDF – Value Flows for a Course of Value System

Value Flows for a Course of Value System Half 1

Value Flows for a Course of Value System Half 2

PDF – Equal Items Of Manufacturing

Equal Items Of Manufacturing

A number of Alternative 1

Accounting Comedian Break

Stream of Supplies, Labor, & Overhead Value By means of Stock Accounts

7 Stream of Supplies, Labor, & Overhead Value By means of Stock Accounts

PDF – 105 Stream of Supplies, Labor & Overhead

105 Stream of Supplies, Labor & Overhead

Brief Calculation Issues 1

A number of Alternative 2

Accounting Comedian Break

Value Per Equal Items – and Assigning Prices Weighted Common Technique

8 Value Per Equal Items – and Assigning Prices Weighted Common Technique

PDF – 110 Strategies to Calculate Ending WIP and Items Accomplished

110 Strategies to Calculate Ending WIP and Items Accomplished

PDF – 115 Equal Items of Manufacturing Weighted Common Technique

115 Equal Items of Manufacturing Weighted Common Technique

Excel Worksheet Obtain

Worksheet – 115 Equal Items of Manufacturing Weighted Common Technique

PDF – 120 Value Per Equal Unit Calculation Weighted Common Technique

120 Value Per Equal Unit Calculation Weighted Common Technique

Excel Worksheet Obtain

Worksheet -120 Value Per Equal Unit Calculation Weighted Common Technique

PDF – 125 Assign Prices to Items Weighted Common Technique

125 Assign Prices to Items Weighted Common Technique

Excel Worksheet Obtain

Worksheet – 125 Assign Prices to Items Weighted Common Technique

Brief Calculation Issues 2

A number of Alternative 3

Accounting Comedian Break

Overhead Prices & Allocation

9 Overhead Prices & Allocation

PDF – 140 Overhead Prices

140 Overhead Prices

PDF – 150 Overhead Allocation Predetermined Overhead Charge

150 Overhead Allocation Predetermined Overhead Charge

PDF – 160 Beneath & Over utilized Overhead

160 Beneath & Over utilized Overhead

Brief Calculation Issues 3

A number of Alternative 4

Accounting Comedian Break

Complete Drawback – Recording Course of Value Journal Entries

10 Complete Drawback – Recording Course of Value Journal Entries

Excel Worksheet Obtain

Half 1

Half 2

Half 3

A number of Alternative 5

Accounting Comedian Break

Complete Drawback – Value Per Equal Items & Value Allocation (FIFO)

11 Complete Drawback – Value Per Equal Items & Value Allocation (FIFO)

Excel Worksheet Obtain

Complete Drawback – Value Per Equal Items & Value Allocation (FIFO)

A number of Alternative 6

Accounting Comedian Break

Key Time period & Definitions

Conversion Prices Definition – What are Conversion Costs_ (1)

Value of Items Accomplished – What’s Value of Items Completed_

Direct Labor Prices Definition – What are Direct Labor Costs_

Direct Supplies Definition – What’s Direct Material_

Equal Items of Manufacturing (EPU) – What are Equal U

Manufacturing unit Overhead Definition – What’s manufacturing unit overhead (1)

Completed Items Stock – What’s Completed Items Inventory_

Oblique Prices Definition – What are Oblique Costs_

Job Order Costing System Definition – What’s Job Order Value (1)

Manufacturing Overhead Definition What’s Manufacturing Ov (1)

Supplies Requisition Definition – What’s Supplies Requisi (1)

Internet Value of Items Manufactured definition – What’s Value of Items Manuf (1)

Overhead Definition – What’s overhead_

Interval Prices Definition – What are Interval Costs_

Prime Prices Definition – What are prime prices

Product Prices Definition – What are Product Costs_

The post Course of Costing System-Value Accounting-Managerial Accounting appeared first on destinforeverything.com.

Please Wait 10 Sec After Clicking the "Enroll For Free" button.